Claim Up to 6% VAT Refund in 3 Simple Steps

While Traveling

STEP 1

At Point of Sales

- Purchase goods from stores displaying the

“VAT REFUND FOR TOURISTS” sign. - Spend at least 2,000 THB

(VAT included) per day, per store. - On the date of purchase, present your passport and ask the sales assistant to issue the VAT Refund Application Form (P.P.10) with the original tax invoices.

Please ensure your passport number is correct.

Goods must be taken out of Thailand within 60 days.

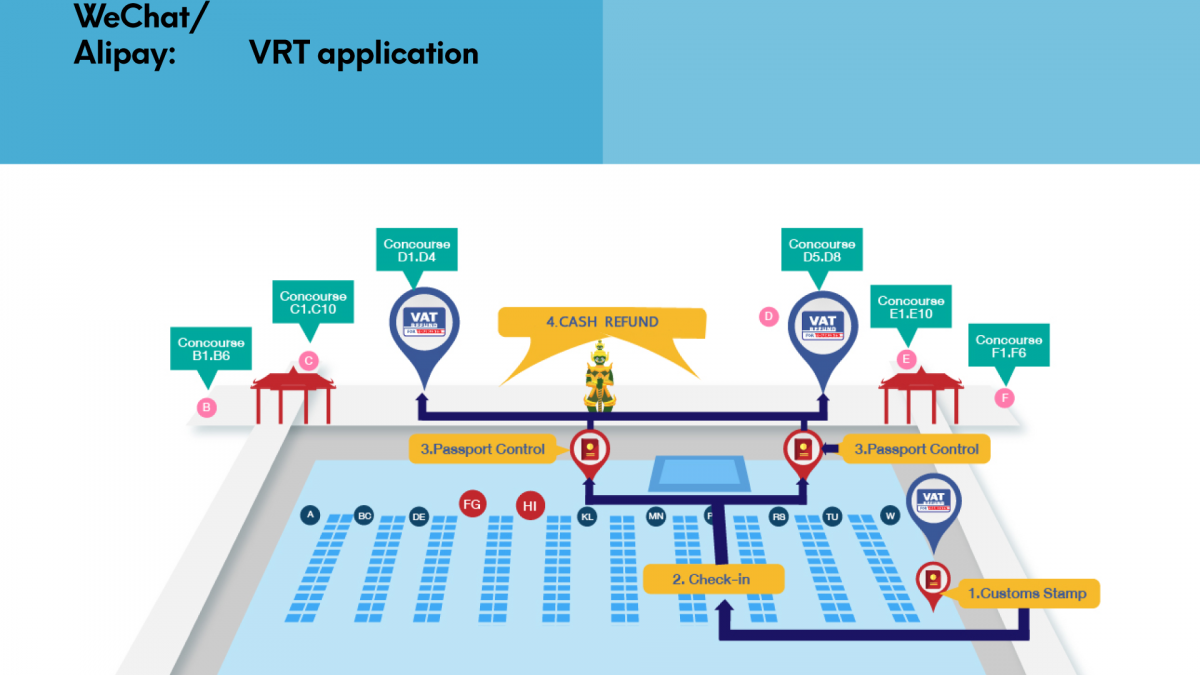

Day of Departure at International Airport

STEP 2

At Customs

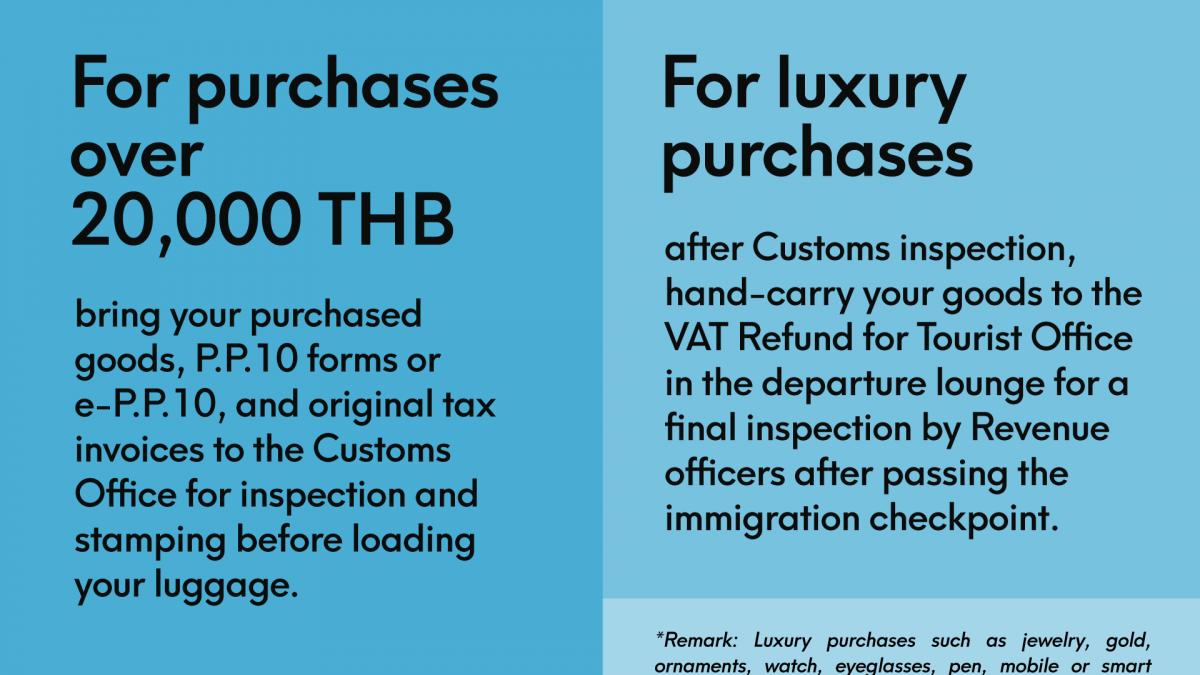

- For purchases over 20,000 THB

Bring your purchased goods, P.P.10 forms or P.P.10.1, and original tax invoices to the Customs Office for inspection and stamping before loading your luggage. - For luxury purchases

After Customs inspection, hand-carry your goods to the VAT Refund for Tourist Office in the departure lounge for a final inspection by Revenue officers after passing the immigration checkpoint.

STEP 3

At VAT Refund Counters

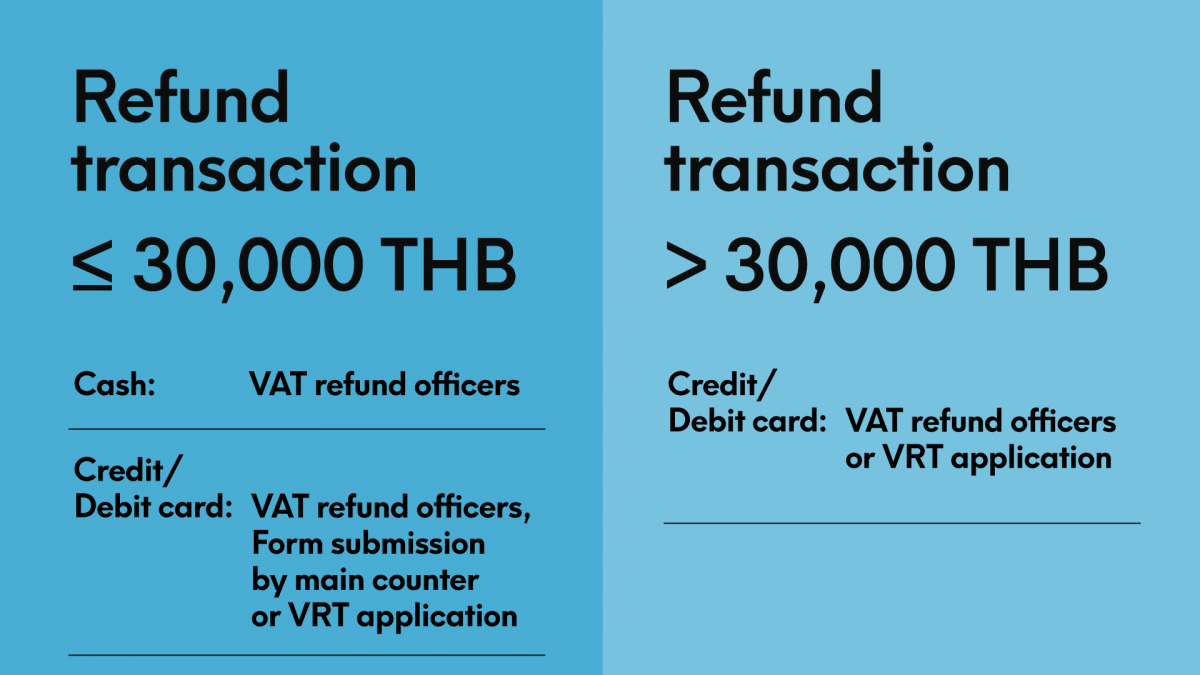

- Refund transaction ≤ 30,000 THB

- Cash: VAT refund officers

- Credit/Debit card: VAT refund officers,

Form submission by main counter or VRT application - WeChat / Alipay: VRT application

- Refund transaction > 30,000 THB

- Credit/Debit card: VAT refund officers or VRT application

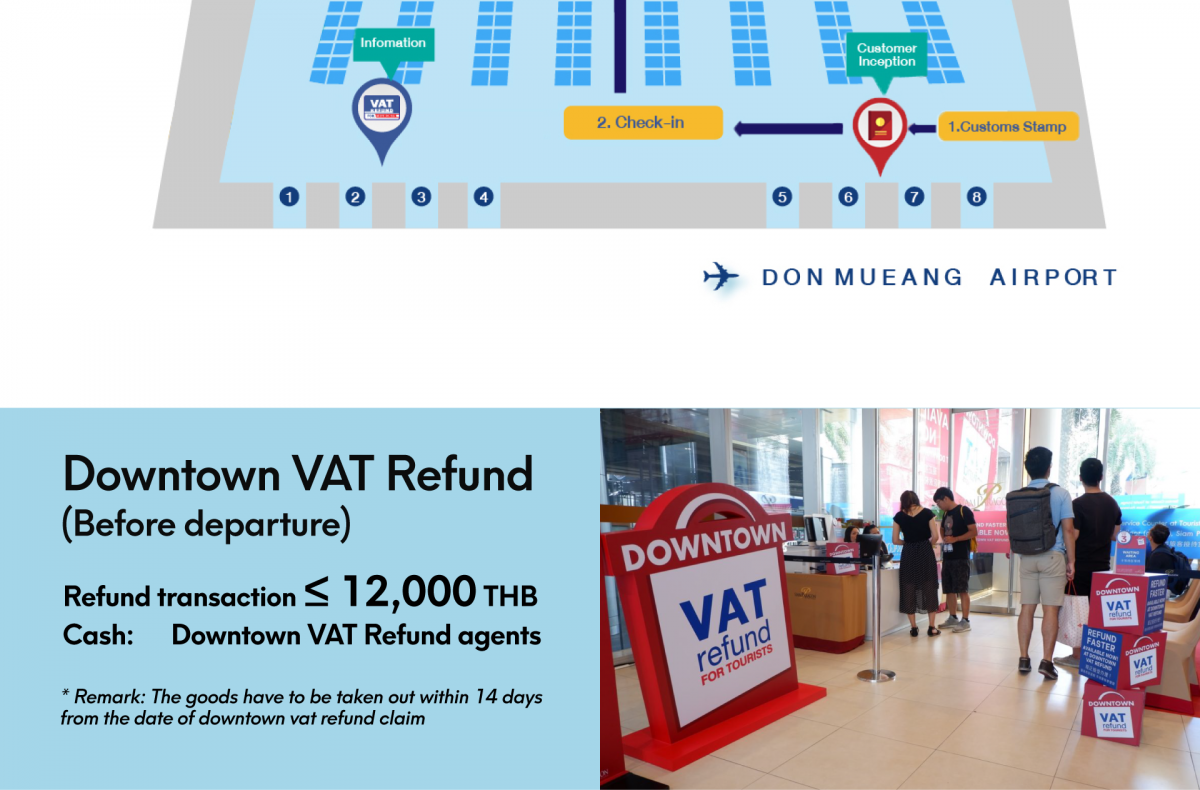

Downtown VAT Refund

(Before departure)

Refund transaction ≤ 12,000 THB

- Cash: Downtown VAT Refund agents

Note: The goods must be exported within 15 days from the date of downtown VAT refund claim.