FASTER / GET CASH IMMEDIATELY

AVAILABLE NOW!!

3 Easy Steps to Get VAT Refund

PLEASE FOLLOW THE PROCESS BELOW

Step 1 Shopping

- Purchase goods from a store displaying the VAT Refund for Tourist Logo of the Revenue Department.

- Spend at least 2,000 baht (VAT included) only on the same day of purchase.

Step 2 Customs Procedure at Suvarnabhumi or Don Mueang International Airport

- Stamped by Customs must show all goods purchased if ≥ 5,000/person on departure date.

Step 3 Refunding

Claim a VAT Refund by :

- Counter VAT Refund at airports

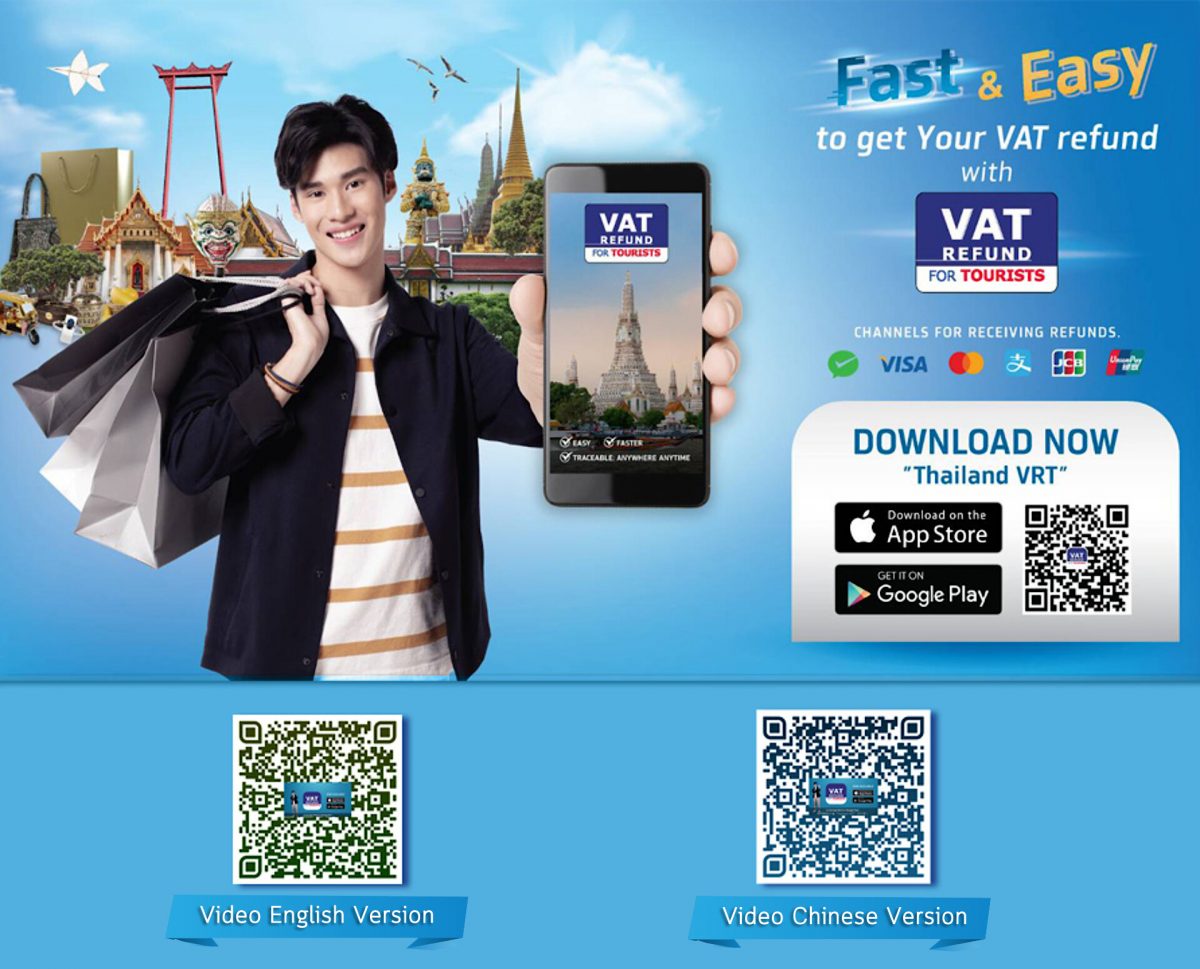

- Thailand VRT Application

- Post (≥ 30,000 baht)

Refunding at Suvarnabhumi or Don Mueang International Airport

For All Goods: Bring the following documents and goods to the Customs Department.

For Luxury Goods (condition #6 of Summary of P.P. 10 section): Bring the following documents and goods to the Revenue Department.

- Summary of P.P.10

- All P.P.10 form

- All tax invoices for goods

Place all stamped documents in the Downtown VAT Refund for Tourist Envelope and drop it in the designated Downtown VAT Refund for Tourist Dropbox @Suvarnabhumi or @DonMueang

Please read the disclaimer below for further discrepancies within the asterisk.

PLEASE READ DISCLAIMERS

*Refunds at the VAT refund counter are denominated in Thai Baht not exceeding 30,000 THB per person, and there are also service fees.

**Request of VAT Refund for Tourists must be within 60 days of first purchase; The day of departure must be within 14 days after receipt of VAT Refund; departure is only permitted from Suvarnabhumi or Don Mueang International Airport.

***Rights are reserved concerning the cancellation of sales and return of goods.

Summary of P.P.10

1. The form must be for the value of goods and not services.

2. The form must be for goods purchased from a shop whose operator sells goods to tourists.

3. The form must be for goods taken out of the country by air within 60 days, counting from the first day of purchase; from either Suvarnabhumi Airport or Don Mueang Airport.

4. The form must not be for goods which are forbidden to be taken out of the Kingdom such as explosives, firearms or unset gemstones.

5. The goods must be inspected by Customs at an international airport.

6. Luxury goods, defined by the Revenue Department as set gemstones, gold jewelry, watches, eyeglasses and pens, otherwise cell phone, tablet and laptops; with a value exceeding 10,000 baht per item, must be taken to the Immigration Bureau for inspection by Revenue Department officials, and receive a signed Revenue stamp.

7. General goods with value exceeding 100,000 Baht per item, must be taken to the Immigration Bureau for inspection by Revenue Department officials, and receive a signed Revenue

As Announced by the Revenue Department

http://www.rd.go.th/publish/55925.0.html